jefferson parish property tax payment

Median Annual Property Tax Payment Average Effective Property Tax Rate. Search the unclaimed property database to see if any of it is yours.

Payments Jefferson Parish Sheriff La Official Website

Jefferson Parish Civil Service Career Opportunities.

. Postal Service money order. 30000 payable to Jefferson Parish Clerk of Court Payment may be made by cash check businesspersonal or US. Inspector General - General Counsel.

The parish is named for. If not property taxes may be paid. LatestStatementYear Statement LatestStatementStatementNumber Mill Levy Rate.

Online filing of wage and tax reports for employers through the wage reporting system of the Louisiana Workforce Commission. Employment with Jefferson Parish Government offers meaningful work serving the community job stability career advancement benefits retirement plan deferred compensation and competitive pay. If your homesteadmortgage company usually pays your property taxes please forward the tax notice to them for payment.

The Service Fee percentage on credit card payments is set by the county collector and there is a 200 minimum charge no matter the amount of the tax payment. A User making a payment using an e-check will be charged a flat Service Fee set by the county collector no matter the amount of the tax payment. A User making a payment using an e-check will be charged a flat Service Fee set by the county collector no matter the amount of the tax payment.

A credit card or a bank account number. Stocks bonds securities and insurance proceeds to the State Treasurers Office. To facilitate your payment and billing for Services facilitate payroll and tax Services for our Customers and detect and prevent fraud.

The Service Fee percentage on credit card payments is set by the county collector and there is a 200 minimum charge no matter the amount of the tax payment. Riders powers of attorney property description exhibits tax certificates and researches mortgage and conveyance certificates resolutions certificates and surveys. Jefferson Davis Parish Profile.

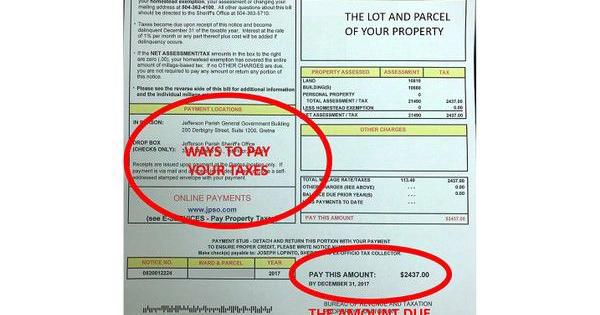

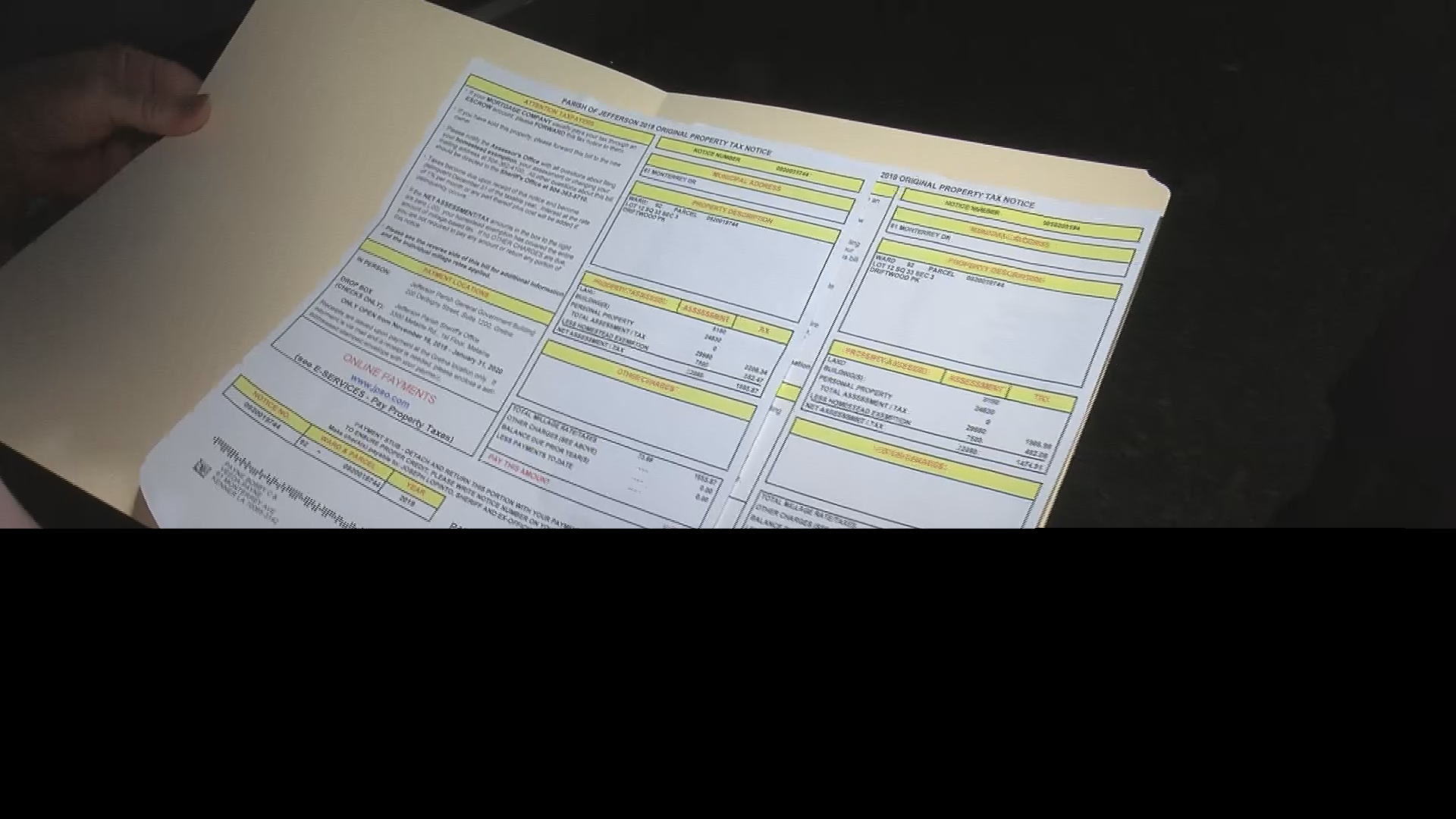

The Jefferson Parish Assessors Office determines the taxable assessment of property. One of the largest recipients of property tax dollars in the parish are local schools. Property tax notices are normally mailed during the last week of November for that taxable year.

Property Maintenance Zoning Quality of Life. If you are seeking certification of taxes paid for the purposes of an act of sale re-financing or to comply with other legal requirements please click the Tax Research Certificate button below to order one online or contact the Bureau of Revenue and Taxation 504 363-5710 for a tax research certificate. Inspector General - Deputy Inspector General Auditor.

Transaction and billing data including the Service purchased billing details financial data corresponding to your selected method of payment eg. Online Payment Pay Parish Taxes View Pay Water Bill.

What Jp Residents Need To Know To Pay Property Tax

Jefferson Parish Sheriff Joseph Lopinto Will Seek Property Tax Increase For Employee Pay Raises Crime Police Nola Com

Payments Jefferson Parish Sheriff La Official Website

Jefferson Parish Property Taxes Are Set For 2018 Local Politics Nola Com

/cloudfront-us-east-1.images.arcpublishing.com/gray/YTRWB54PLJFCTIWMMQAFXOG46U.bmp)

Jefferson Parish Residents Receiving Sticker Shock At Property Tax Bills

Jefferson Parish Voters Approve New Property Tax Increase For Sheriff S Office Pay Raises Local Elections Nola Com

Poll Taxes In The United States Wikiwand

/cloudfront-us-east-1.images.arcpublishing.com/gray/YTRWB54PLJFCTIWMMQAFXOG46U.bmp)

Jefferson Parish Residents Receiving Sticker Shock At Property Tax Bills

Payments Jefferson Parish Sheriff La Official Website

Jefferson Parish Property Taxes Due Sunday Local Politics Nola Com

Jefferson Parish Property Owners Will Pay More Taxes Soon Here S Why Local Politics Nola Com

Jefferson Parish Property Taxes Due Sunday Local Politics Nola Com

Jefferson Parish Residents Receiving Sticker Shock At Property Tax Bills

Jefferson Parish Sales Tax Exemption Certificate Fill Online Printable Fillable Blank Pdffiller